Our vision

To be a leading annual market value assessment jurisdiction, earning the respect and trust of our customers every day.

On behalf of the Assessment management team, I am pleased to present Assessment’s 2014 Annual Report, highlighting key activities and accomplishments over the past year.

Continuing our theme of exceeding customer expectations, and in response to customer feedback, we enhanced a number of customer-facing communication pieces, including our assessment notices and informational brochures. We also improved the Advance Consultation Period and began working on our websites, calgary.ca/assessment and calgary.ca/assessmentsearch.

The quality of our valuations remained extremely high and in 2014 we made further improvements to the valuation process. The accuracy in our values continues to be reflected in the relatively low number of complaints filed.

Every year we challenge ourselves to improve the way we do business to remain a leading assessment jurisdiction. In addition to improving our valuation process, we continued to recruit highly qualified staff and began a multi-year project to replace our core technology system with a new and more sustainable system.

We provided a detailed submission to The Government of Alberta’s review of the Municipal Government Act (MGA). The MGA is the leading piece of legislation for Alberta municipalities and as such, greatly impacts us. The opportunity to further improve our ability to conduct fair and equitable assessments for The City of Calgary is one we welcome.

I am very pleased with the work of our staff and with what we achieved in 2014. Our values are strong, the number of complaints remained low and we’re on track to make further enhancements in 2015.

To be a leading annual market value assessment jurisdiction, earning the respect and trust of our customers every day.

In serving our customers – the taxpayers, The City of Calgary, and the Province of Alberta – we:

Assessment is governed by the Municipal Government Act (MGA) of the Province of Alberta and civic bylaws. We adhere to this legislation through our activities preparing, communicating and defending assessments.

We work to ensure:

Our work stays on pace with one of the most dynamic real estate markets in the country. Our assessment professionals are experts in their respective field and use some of the industry’s most advanced analytical appraisal tools to prepare property and business assessments.

Assessment’s core business focuses on completing three activities in an annual cycle:

1 Preparing annual property and business assessments.

2 Communicating assessed valued to property and business owners.

3 Defending assessments to ensure equity for Calgary taxpayers.

Prepare annual property and business assessments.

To ensure equity for all property and business owners, Assessment:

Click an image to view the details

The Assessment Management Team oversees Assessment’s strategic direction and management.

Annual property and business assessments reflect Calgary’s market conditions as of July 1 of the previous year.

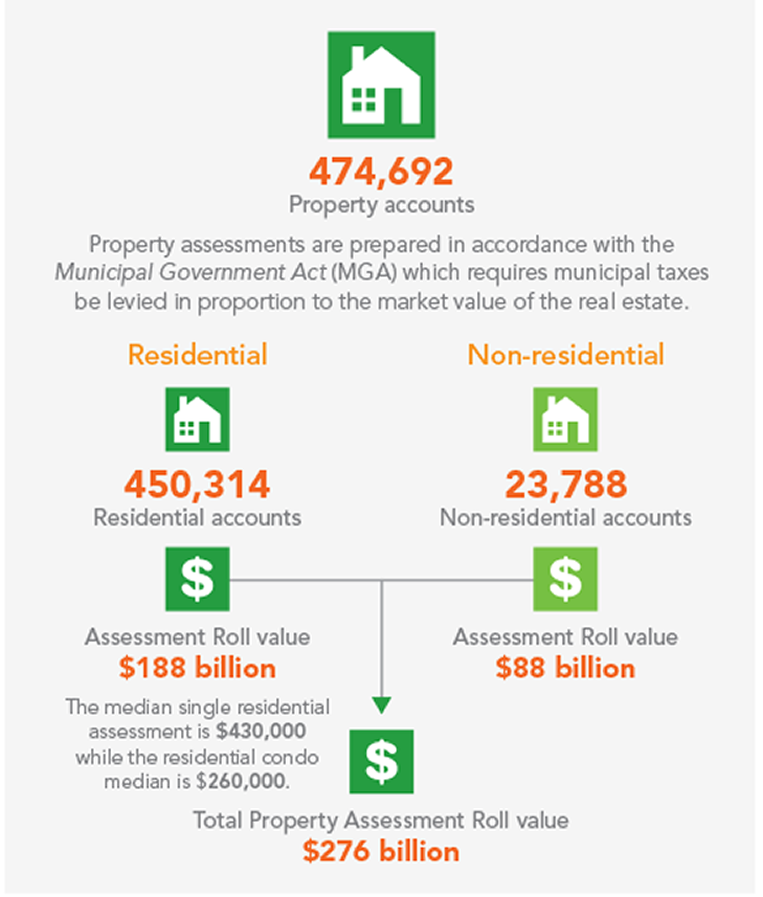

Assessment values provide the basis for approximately $2.2 billion in property and business tax revenues.

26,358

Total business taxable accounts

Business assessments are prepared in accordance with the MGA and civic bylaws.

Business assessment increased by six per cent.

Business Assessment Roll value

$3.15 billion

In addition to preparing the Roll, Assessment handles maintenance throughout the year.

| 2013 Roll | 2014 Roll | |

|---|---|---|

| Total taxable property assessment value | $235 billion | $256 billion |

| Residential and multi-residential base assessment value | $174 billion | $187 billion |

| Farm land base assessment value | $11 million | $12 million |

| Non-residential base assessment value | $61 billion | $69 billion |

| Total taxable business assessment value | $2.96 billion | $3.15 billion |

| 2013 Roll | 2014 Roll | |

|---|---|---|

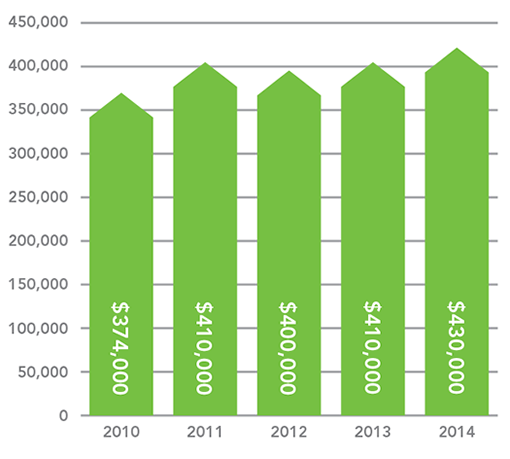

| Median single residential assessment (excluding condominium) | $410,000 | $430,000 |

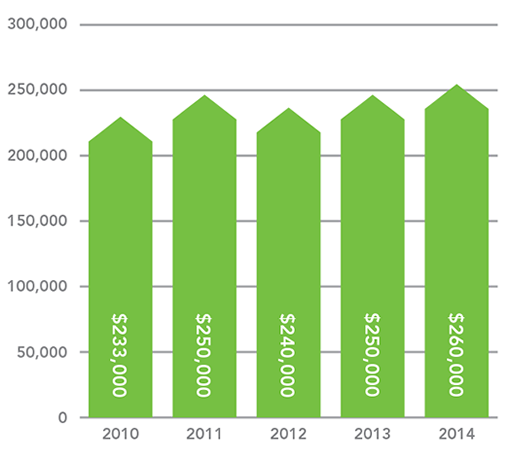

| Median residential condominium assessment | $250,000 | $260,000 |

| Typical residential market value change | 3% | 6% |

| Typical non-residential market value change | 20% | 11% |

| Typical net annual rental value change (Business Assessment) | 7% | 6% |

| 2013 Roll | 2014 Roll | |

|---|---|---|

| Residential (including multi-residential accounts) | 440,424 | 449,051 |

| Farm land | 608 | 590 |

| Non-residential | 14,635 | 14,575 |

| Total | 455,667 | 464,216 |

| 2013 Roll | 2014 Roll | |

|---|---|---|

| Annual property assessment notices | 464,574 | 473,295 |

| Amended and supplementary property assessment notices | 10,512 | 17,545 |

| Total | 475,086 | 490,840 |

| 2013 Roll | 2014 Roll | |

|---|---|---|

| Single residential | 9,001 | 10,384 |

| Residential condominium | 455 | 564 |

| Total | 9,456 | 10,948 |

| 2013 Roll | 2014 Roll | |

|---|---|---|

| Office | 6,346 | 6,450 |

| Industrial/warehouse | 7,923 | 8,082 |

| Shopping centres | 6,928 | 7,105 |

| Retail | 3,654 | 3,647 |

| Accommodation | 160 | 162 |

| Parking | 578 | 605 |

| Other | 379 | 307 |

| Total | 25,968 | 26,358 |

| 2013 Roll | 201 Roll | |

|---|---|---|

| Annual business assessment notices | 26,260 | 26,358 |

| Amended and supplementary business assessment notices | 3,876 | 4,244 |

| Total | 30,136 | 30,602 |

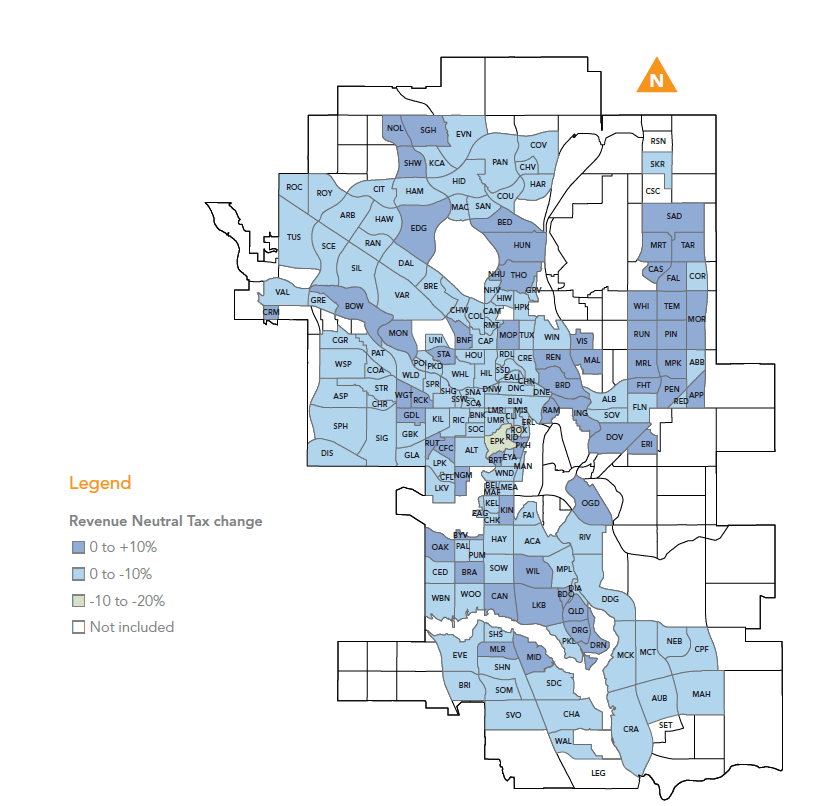

(per cent by community)

Residential communities

Our 2014 Assessment Roll met the Provincial Assessment Quality Standards for the residential and non-residential property classes, confirming that Assessment continues to follow legislated and professional standards.

There are two main quality measures that are regulated by the provincial government and used to determine the accuracy of assessments: the level of assessment and the uniformity of assessment.

The statistical quality measure of the overall level of assessment for residential property in 2014 was 99.9 per cent and for non-residential property was 97.9 per cent. This quality measure shows the typical relationship between the assessed value determined by Assessment and the actual sale price for all properties that sold during the valuation time frame.

Assessment has internal, as well as provincial controls and measures in place to achieve high quality standards. Assessed values also go through a final important quality check – review by property and business owners.

| Key performance indicator results | Provincial quality standards | Actual 2013 (%) | Actual 2014 (%) |

|---|---|---|---|

| Residential overall ratio (assessment level)* | Property containing 1, 2 or 3 dwelling units. Median assessment ratio 0.950 – 1.050 | 99.8 | 99.9 |

| Non-residential overall ratio (assessment level) | All other property. Median assessment ratio 0.950 – 1.050 | 97.0 | 97.9 |

| Coefficient of dispersion** for single family dwellings | Property containing 1, 2, 3 dwelling units Coefficient of dispersion 0 – 15.0 | 6.2% | 5.9% |

| Coefficient of dispersion for non-residential | All other property Coefficient of dispersion 0 – 20.0 | 10.5% | 11.8% |

*The common or overall ratio of assessed values to market values.

**The average percentage deviation from the median ratio.

Assessment is committed to providing property and business owners with timely and transparent communication.

Property and business taxes are calculated based on assessment values. It is therefore important that property and business owners understand how their assessment was derived to ensure accuracy and that they pay the correct amount of taxes.

2924 11 Street N.E., Calgary

Please call in advance to book an appointment.

The City of Calgary, Assessment (#8002), P.O. Box 2100, Stn. M, Calgary AB, T2P

Assessment offers a year-round inquiry service staffed by valuation professionals, and two consultation periods to assist customers with their assessments.

By providing accessible, convenient customer support, we hope to increase taxpayers' understanding of the assessment process, facilitate opportunities for two-way dialogue and resolve customer concerns.

Held annually, several months before the assessment notices are mailed, the Advance Consultation Period provides non-residential property and business owners the opportunity to review their preliminary assessment value and exchange information with us prior to the assessment rolls being finalized. Sharing preliminary assessment information provides non-residential property and business owner’s greater ability to manage their assessment and tax planning activities while enabling Assessment to continue preparing fair and equitable assessments.

The Advance Consultation Period for the 2015 assessment roll ran from Oct. 6 - Nov. 6, 2014. It included an industry representative forum for tax agents and corporate representatives to share:

The 60-day Customer Review Period provides owners with the opportunity to understand, review and inquire about their assessment. Customers can also access and review their assessment online at calgary.ca/assessmentsearch. By securely logging into Assessment Search, customers can review sales of similar properties and compare for equity with the same real estate market information used to prepare 2014 property assessments.

To inform customers about the upcoming mail out of assessment notices, Assessment conducts an extensive public awareness campaign. The following communication channels are used to reach property and business owners:

Each year, the numbers of visits to the Assessment Search website (calgary.ca/assessmentsearch) increases, confirming that property and business owner’s rely on the information and services provided there. Incoming inquiries to Assessment’s customer service line and response times are monitored daily to ensure prompt and accurate customer service is being provided to citizens.

Customer inquiries made by phone, fax, mail or in person

6,180

Inquiries

1,083

Inquiries

2,178

Assessor appointments

38

Tax agent representatives in attendance at 2014 Industry Representatives Forum

477,399

Inquiries

Customer inquiries made by phone, fax, mail or in person

1,806

Assessor appointments

978

Assessment information requests processed (Assessment explanation supplement reports)

128,424

2014 web visits to Assessment Search (60 days)

6,056

Inquires closed by end of Customer Review Period

11 seconds

Average wait time

98%

Per cent of phone calls resolved

This year's Advance Consultation Period saw our highest level of participation since it started seven years ago.

Each year, Assessment reaches out to property owners in its efforts to continually exceed customer expectations. Satisfaction continues to remain high.

An important component of Assessment’s role is to defend assessments under complaint to ensure equity for all property and business owners. Fortunately, our steadfast commitment to product quality has resulted in a substantial decrease in complaints.

In addition, we strive to address assessment issues outside the formal complaint process and encourage customers to contact our customer service line at 403-268-2888 with any concerns they may have about their assessment. Concerns may be able to be addressed without the need for a formal hearing.

In 2014, there were 3,455 complaints filed against assessments. The total assessment value under complaint is 17.9% per cent of the assessment base. The residential assessment value represents approximately 1.3% of the assessment base and the non-residential assessment value under complaint equates to 64.5% of the assessment base.

Reducing the number of complaints allows Assessment to mitigate financial risks to The City’s revenue stream, while also allowing assessors to spend more time preparing and communicating assessments to better serve customers.

| Account type | Number of taxable accounts | Total number of complaints | Percentage of all complaints | Confirmed by Assessment Review Board

# % |

Revised by Assessment Review Board decision

# % |

Resolved without hearing

# % |

|---|---|---|---|---|---|---|

| Property | 464,216 | 2,583 | 74.7% |

1,110

43.0%

|

801

31.0%

|

672

26.0%

|

| Residential | 449,051 | 742 | 21.5% |

320

43.1%

|

192

25.9%

|

230

31.0%

|

| Non-Residential | 14,575 | 1,819 | 52.6% |

781

42.9%

|

606

33.3%

|

432

23.7%

|

| Farm Land | 590 | 22 | 0.6% |

9

40.9%

|

3

13.6%

|

10

45.5%

|

| Business | 26,358 | 873 | 25.3% |

429

49.1%

|

214

24.5%

|

230

26.3%

|

| Totals | 490,574 | 3,456 | 100.0% |

1,539

44.5%

|

1,015

29.4%

|

902

26.1%

|

In 2012, Council moved to consolidate Calgary’s business tax with the non-residential property tax. The process will transfer Calgary’s business tax revenue to the non-residential property tax through a series of incremental tax revenue transfers over seven years.

The process began in 2013 with a zero per cent revenue transfer and will end with the elimination of the business tax in 2019.

In 2014, 10 per cent of business tax revenues were transferred to and collected through the non-residential property tax. This resulted in a 10 per cent decrease to the business tax rate and an estimated 2.7 per cent increase to the non-residential property tax rate. The incremental revenue transfers will occur annually until 2019, culminating with the elimination of the business tax.

The consolidation process is expected to enhance Calgary’s economic competitiveness and attractiveness and continue to make our city a great place for businesses to start and flourish.

Customers can find more information about business tax consolidation at calgary.ca/btc.

| Year | Business tax change | Non-residential property tax change |

|---|---|---|

| 2013 | 0% | 0% |

| 2014 | -10% | 2.7% |

| 2015 | -10% | 2.7% |

| 2016 | -20% | 5.4% |

| 2017 | -20% | 5.4% |

| 2018 | -20% | 5.4% |

| 2019 | -20% | 5.4% |

| Totals | -100% | 27% |

The business tax, for business tax revenue purposes, will be eliminated in 2019.

*The 2014-2019 figures are based on the estimated 2015 tax rates. The annual tax implications will vary based on changes to property/premises details, annual re-assessment shifts and/or annual Council or provincial tax rate adjustments.

Calgary remains a very dynamic city with an abundance of growth and opportunity. To prepare for continued success as a leading market value assessment jurisdiction, we will continue to monitor market conditions and work to exceed customer expectations.

In our effort to make information more accessible, we will continue to move more customer services online and further improve our valuation process to ensure accuracy.

The commitment and hard work of our employees will enable us to achieve our goals in 2015 and the years ahead.